Bank of Canada’s October 2025 Rate Cut: A Turning Point for Homebuyers and the Economy?

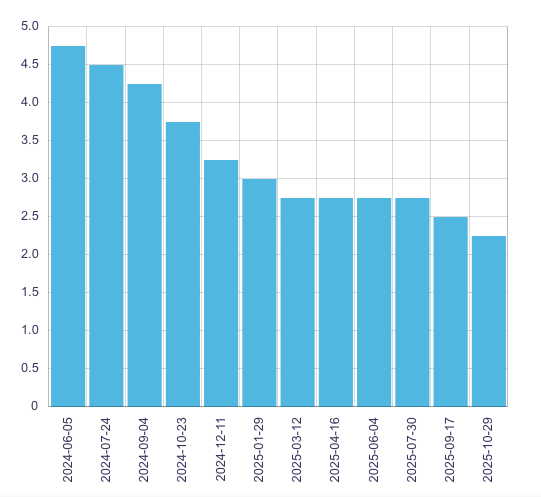

The Bank of Canada (BoC) delivered a much-anticipated 25-basis-point rate cut on October 29, 2025, lowering its benchmark rate to 2.25%—its lowest level since early 2022. This marks the second consecutive cut, following a similar reduction in September, and signals a pivotal shift in monetary policy aimed at supporting an economy grappling with weak growth, trade uncertainty, and persistent inflation pressures.

Why the Cut Matters

Governor Tiff Macklem emphasized that the economy is undergoing a “period of structural adjustment,” largely due to unpredictable U.S. trade policies and tariffs. While inflation rose to 2.4% in September—up from 1.9% in August—core inflation measures suggest price growth is stabilizing. With GDP contracting by 1.6% in Q2 and unemployment holding steady at 7.1%, the BoC sees the current rate as “about the right level” to balance inflation control with economic support.

Immediate Impact on Mortgage Holders

Variable-rate mortgage holders will feel the benefits immediately. A 25-basis-point drop translates to meaningful savings: for a $627,404 mortgage, monthly payments could decrease by $83, or nearly $1,000 annually. Lenders have already adjusted their prime rates to 4.45%, pushing the lowest five-year variable rates down to 3.45%.

Fixed-rate mortgages, while not directly tied to the BoC’s rate, are also trending lower. The five-year government bond yield—a key benchmark—has dipped to around 2.5–2.6%, helping drive the best fixed rates to 3.79%, a level not seen since spring 2025.

Mixed Signals for the Housing Market

Real estate leaders like Karim Kennedy of Coldwell Banker Canada welcome the cut, calling it a signal of support that could unlock pent-up demand. He predicts a housing market rebound by year-end. However, others, like Morguard’s Keith Reading, remain cautious. Affordability remains a major hurdle, especially for first-time buyers, and ongoing trade uncertainty dampens confidence.

“People don’t know what the market will look like in three or six months,” Reading noted, highlighting the hesitation among potential buyers despite lower borrowing costs.

What’s Next?

The BoC suggests this could be the last cut for a while. With economic projections showing growth of 1.2% in 2025, 1.1% in 2026, and 1.6% in 2027, the central bank believes the current rate is sufficient if inflation evolves as expected. Markets now price in a high likelihood of a rate hold in December, with only a slim chance of further cuts in early 2026.

For investors, lower rates reduce borrowing costs for Real Estate Investment Trusts (REITs), potentially making them more attractive as defensive assets in uncertain times.