Understanding Property Transfer Tax (PTT) in BC: What Buyers Need to Know

Buying a home in British Columbia comes with several costs, and one of the significant expenses is the Property Transfer Tax (PTT). Whether you’re a first-time home buyer or purchasing a newly built home, it’s important to understand how this tax works, as well as the potential exemptions that could save you thousands of dollars.

What is Property Transfer Tax (PTT)?

Property Transfer Tax is a tax paid by the buyer when a property is transferred from one owner to another. The tax is based on the Fair Market Value (FMV) of the property on the date of registration. In BC, the tax rates are as follows:

- 1% on the first $200,000 of the property’s FMV.

- 2% on the portion of the FMV between $200,000 and $2,000,000.

- 3% on the portion of the FMV between $2,000,000 and $3,000,000.

- 5% on any portion of the FMV over $3,000,000.

For example, if you purchase a home valued at $2,500,000, the PTT calculation would be:

- 1% of $200,000 = $2,000

- 2% of $1,800,000 ($2,000,000 – $200,000) = $36,000

- 3% of $500,000 ($2,500,000 – $2,000,000) = $15,000

Total PTT = $2,000 + $36,000 + $15,000 = $53,000

As you can see, the tax can be substantial, so it’s important to know about exemptions that might apply to you.

First-Time Home Buyer Exemption

The First-Time Home Buyer Exemption is designed to help new buyers reduce or eliminate their PTT costs. If you qualify, you could save thousands of dollars when purchasing your first home. Here’s how it works:

- Full Exemption: If the FMV of the property is $500,000 or less, you are eligible for a full exemption, meaning you do not have to pay any PTT.

- Partial Exemption: If the FMV is between $500,000 and $835,000, you may be eligible for a partial exemption of $8,000.

- Sliding Scale Exemption: For properties valued between $835,000 and $860,000, the exemption is gradually reduced. The formula used is a $320 deduction per $1,000 of value over $835,000.

- No Exemption: If the FMV exceeds $860,000, the first-time home buyer exemption does not apply.

Example:

If you purchase a home valued at $800,000, you would receive a partial exemption of $8,000. If the home is valued at $845,000, the exemption amount would be reduced based on the sliding scale.

Do I qualify? Learn more about First-Time Home Buyer qualifications here.

Newly Built Home Exemption

The Newly Built Home Exemption is intended to help buyers of brand-new homes by reducing or eliminating the PTT. Here’s how it applies:

- Full Exemption: If the FMV of the newly built home is $1,100,000 or less, you qualify for a full exemption from PTT.

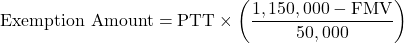

- Partial Exemption: For homes with an FMV between $1,100,000 and $1,150,000, the exemption amount is proportionally reduced. The formula for the partial exemption is below.

- No Exemption: If the FMV is over $1,150,000, the newly built home exemption does not apply.

Example:

If you purchase a newly built home valued at $1,120,000, the exemption would be calculated based on the partial exemption formula, reducing the PTT you need to pay.

PTT Calculator

Quickly calculate your amount of PTT and exemption using my PTT Calculator here.

How to Claim Your Exemptions

To claim these exemptions, you will need to:

- Declare your eligibility when registering the property transfer.

- Provide supporting documentation, such as proof that you are a first-time home buyer or that the home is newly built.

Tips for Buyers

- Plan Your Budget Carefully: Even with exemptions, the PTT can be a significant cost, so make sure to budget for it when planning your home purchase.

- Check Your Eligibility: Ensure you meet the requirements for the exemptions. For instance, first-time buyers must have never owned a principal residence anywhere in the world.

- Work with a Real Estate Professional: A knowledgeable agent can help you navigate these rules and ensure you’re taking advantage of any available exemptions.

Conclusion

The Property Transfer Tax can be a significant cost for home buyers in BC, but understanding how it works and knowing about available exemptions can help you save money. Whether you're a first-time buyer or purchasing a newly built home, these programs are designed to ease the financial burden and help you get into your new property with lower costs.

If you have any questions or need help with your home purchase, feel free to contact me for expert guidance.